[Editorial] Global chips race

Korea needs to hasten deregulation, innovation to survive in chips race

By Korea HeraldPublished : Feb. 26, 2024 - 05:28

With the US and Japan pulling out all the stops to reclaim global leadership in semiconductor manufacturing, South Korea risks losing its competitive edge in chipmaking if it doesn’t speed up deregulation and innovation.

US Commerce Secretary Gina Raimondo said last week the US would need a second CHIPS Act if it wants to “lead the world” in the semiconductor supply chain and meet demand from artificial intelligence technologies. The CHIPS and Science Act, signed by US President Joe Biden in 2022, set aside $39 billion in direct grants, and an additional $75 billion in loans and loan guarantees worth $75 billion, to boost domestic semiconductor production.

US semiconductor manufacturer Intel, which has unveiled plans for a $20 billion plant in Ohio and $20 billion expansion in Arizona, is discussing over $10 billion in grant and loan incentives. Intel said last week that it has signed Microsoft as a foundry customer and that it expects to beat Taiwan Semiconductor Manufacturing Co. in advanced chip manufacturing ahead of an internal deadline of 2025. Intel also seeks to mass-produce 1.8nm chips by late this year, ahead of Samsung and TSMC plans to manufacture 2nm chips in large quantities next year. It also set the same goal of producing ultrafine 1.4nm chips as Samsung and TSMC by 2027.

“To be clear, we can‘t and do not want to make everything in America,” Raimondo said during a virtual appearance at an Intel event last week.

“But we do need to diversify our semiconductor supply chains and have much more manufacturing in the US, particularly leading-edge chips, which will be essential for AI.”

Japan, for its part, has been spending heavily to persuade companies such as TSMC, Samsung Electronics and Micron Technology to move their facilities to the country to secure a supply of chips used in cars and mobile phones.

On Saturday, TSMC opened its first semiconductor plant in Japan on what used to be a cabbage field in Kumamoto, marking a head start in the global chip race. Despite early projections that it will take about five years to build, Japan managed to make it happen in just two years with efficient government support and construction work that went on for 24 hours, seven days a week. It was completed just two years and four months after TSMC announced its investment plan in Kumamoto in October 2021. The Japanese government eased half-century-old regulations to build the foundry in the middle of a farmland, and provided 40 percent of the cost of the plant in subsidies.

Tokyo will provide an additional $4.86 billion in subsidies for the Taiwanese chip giant to expand its plants in the country, Japan’s economy minister said at the opening ceremony for the new factory. TSMC is set to build a second plant in Japan, with production projected to begin in about three years.

Also last week, global equities were buoyed by a single stock -- US chip designer Nvidia -- which reported blowout earnings on soaring demand for its chips used to power AI applications. The Dow Jones Industrial Average marked its first-ever close above 39,000, and Japan’s Nikkei Stock Average returned back to where it was 34 years ago.

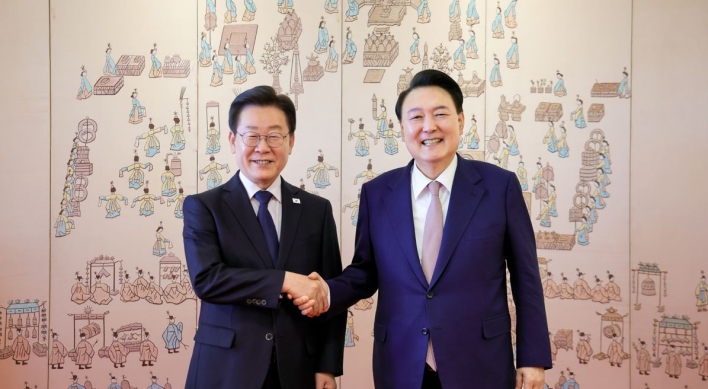

The situation in South Korea, however, is rather unpromising. The site of the semiconductor cluster of SK hynix in Yongin, Gyeonggi Province, was selected in 2019, but the groundbreaking was delayed five times due to local administrative issues over water and power supply. Its construction is finally set to begin in March next year. A government plan to extend the temporary tax credits for facility investments in semiconductors, which expires this year, to 2030, has been criticized by the majority-controlling Democratic Party of Korea as “preferential treatment for large conglomerates.” The government announced a plan last month to form a massive semiconductor chip cluster in southern Gyeonggi Province, but it is slated to be completed by 2047. The Korean government, politicians and businesses must employ every means possible to deregulate and innovate before it gets too late in the intensifying global chips war.

-

Articles by Korea Herald

![[KH Explains] No more 'Michael' at Kakao Games](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/28/20240428050183_0.jpg&u=20240428180321)

![[Grace Kao] Hybe vs. Ador: Inspiration, imitation and plagiarism](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/28/20240428050220_0.jpg&u=)