Auto chip shortage expected through 2022, reliance on TSMC to surge: report

By Shim Woo-hyunPublished : July 12, 2021 - 17:19

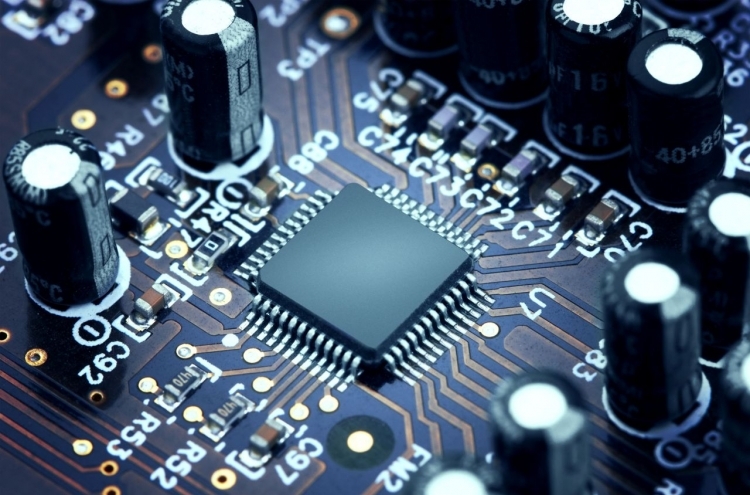

A global shortage of automotive chips is expected to last through next year, while efforts to localize production are not advancing fast enough, a local auto industry think tank said Monday.

The Seoul-based Korea Automotive Technology Institute, in a report, predicted the situation will slowly get better for automakers, starting in the second half of this year. But, the supply will remain constrained by 2022.

A global lack of chips has forced many automakers to suspend car production, including South Korea’s Hyundai Motor. Typically, a modern car needs hundreds of chips to control various smart features and systems, including the engine.

The KATI’s report noted that the Korean car industry has sought partnership with local foundries to ensure stable supply of crucial auto chips. But the foundry firms hesitate to expand their auto chip production capacity as it could take years to recoup spending on equipment and facilities.

Earlier this year, Hyundai Motor Group officials met with local fabless companies in hopes to shift chips like microcontroller units to South Korean designers. The discussion between Hyundai Motor Group and local semiconductor players is, however, still in the early stage, the report said.

The institute called for a high-level partnership between Hyundai Motor Group and the country’s largest memory chip maker Samsung Electronics to address the auto chip woes.

Globally, major chip companies are stepping up their efforts to increase their production of automotive chips – some at the nudge of the government.

Intel plans to start manufacturing chips for US car companies such as Ford Motor Co. and General Motors.

Toyota also invested in Renesas, the world‘s leading supplier of microcontrollers, while the Japanese government proposed TSMC to build an advanced chip factory in Japan.

The institute also noted the risks involved in the global car industry’s heavy reliance on Taiwan Semiconductor Manufacturing Co., which is only expected to grow.

TSMC, the world’s largest contract chip maker, currently accounts for about 70 percent of global contract production of micro control units used in cars.

![[KH Explains] Can tech firms' AI alliances take on Nvidia?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/07/20240507050619_0.jpg&u=)

![[Grace Kao, Meera Choi] Has money displaced romance on dates?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/06/20240506050233_0.jpg&u=)

![[K-pop’s dilemma] Time, profit pressures work against originality](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/05/08/20240508050705_0.jpg&u=20240508171126)

![[Today’s K-pop] NCT Dream to drop pre-release from 2nd Japan single](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/05/08/20240508050725_0.jpg&u=)