Hong vows deregulation for nonspeculative home buyers

By Bae HyunjungPublished : Oct. 28, 2020 - 17:18

Responding to continuing public complaints that the latest and forthcoming real estate policies impose excessive burdens upon nonspeculative end users, the South Korean government is set to lowering the tax rate for budget residences, the nation’s fiscal chief said Wednesday.

He also rolled out a “phased” housing system that would allow prospective homebuyers with limited credit to eventually own a residential home by accumulating stake in the given property throughout the preset period.

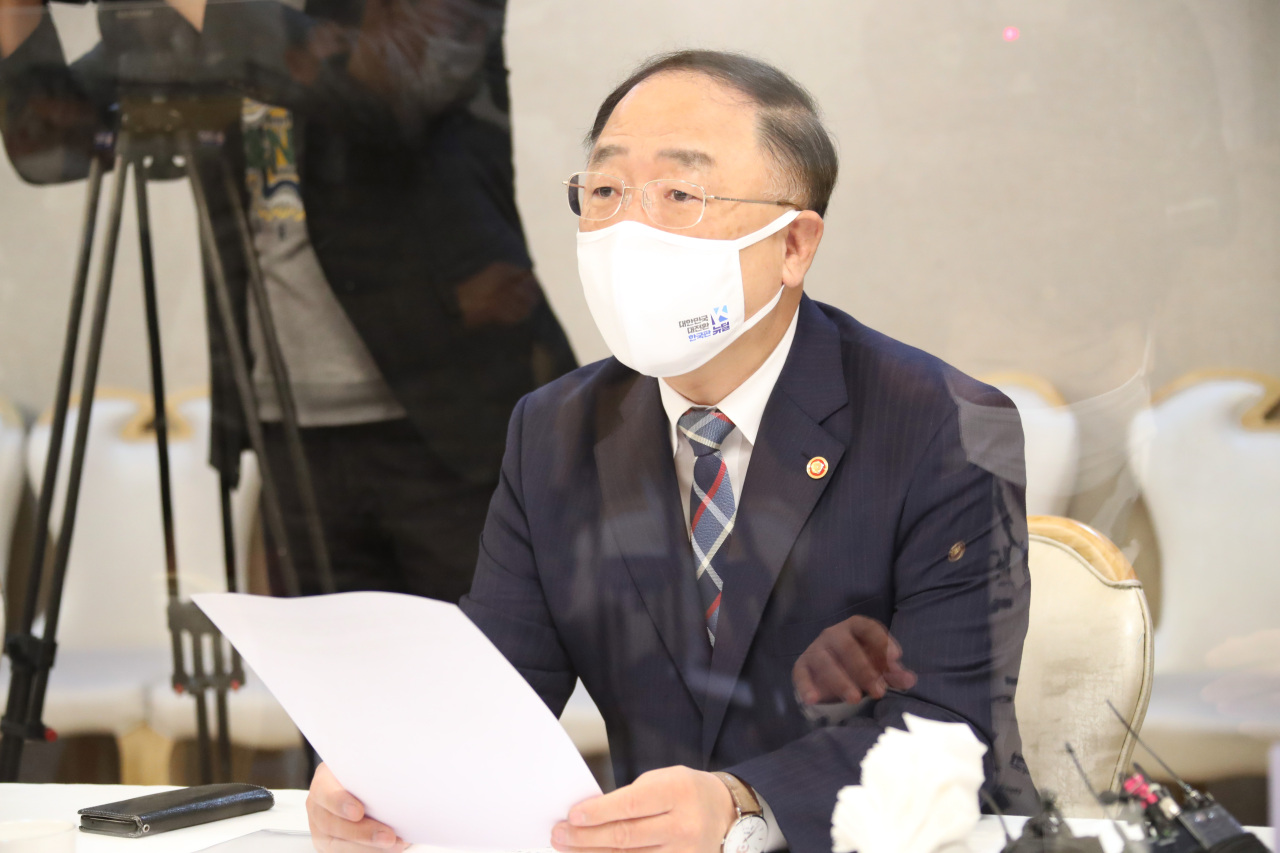

“(The domestic real estate market) is currently going through a transition period due to new legal systems such as the ‘three tenant’ protection laws,” said Deputy Prime Minister and Finance Minister Hong Nam-ki in an economy-related ministerial meeting held at Seoul Government Complex.

Adding further to the market fluctuation are policy factors such as prolonged low interest rates and seasonal reasons with more people usually moving home in the fall, according to the minister.

“The government will remain consistent in (real estate) policies, so that (the country) may swiftly move past the transitional ‘dead point’ and recover its second wind,” he said.

The top policymaker’s remarks largely addressed the turbulence in jeonse home supplies, which was attributed to the recently effectuated tenant protection rules. While the new laws allow tenants to extend their jeonse home rental deal by another two years, they were also seen as reducing the market supply as landlords turned reluctant to putting their property on the market.

The contracted jeonse market acted as a double whammy for nonhomeowners, who faced hurdles in finding a valid residence amid a heating market.

In a move to supplement its residential regulatory frame, the government will introduce a new housing program that will lower the acquisition threshold for aspiring homebuyers starting from 2023, Hong said.

Under the plan, residents are initially required to hold 20-25 percent stakes in a given property, after which they are to fulfill 20-40 years in actual occupancy in order to obtain ownership.

Throughout the residential period, the tenant may gradually acquire the remaining stake -- 10-15 percent every four years -- and pay lower-than-average rent.

This system was suggested in the government’s earlier real estate policy package on Aug. 4.

“We expect that this (phase-in) housing program will serve as a new supply model that meets the demands of (nonspeculative) end users,” Hong said.

Also, the government and the ruling party are working on revising the tax plan for single home owners with budget properties, in an apparent move to balance the policy actions to regulate multiple ownership of high-priced houses.

“We will ensure that the property tax burden does not escalate for ordinary people who own a single unit of budget residence,” Hong said.

Policymakers have been seeking to revise the tax base system so as to reduce the gap between declared value and market value in the housing market.

The plausible revision scenario is to exempt up to 50 percent in property tax for those who own just one apartment priced 900 million won ($796,000) or less, while imposing tightened tax rules on high-priced property holders or multiple-home owners.

Meanwhile, private sector data showed that real estate assets continue to account for a majority of the wealthy’s assets.

According to the Korea Wealth Report released by KB Financial Group’s research institute, real estate accounted for 56.6 percent of the assets held by those with a worth of 1 billion won or more as of end-2019. The figure was up 2.9 percentage point from a year earlier and marked the highest figure since 2013.

Their financial asset ratio, on the other hand, slipped to a seven-year low of 38.6 percent, as the rich preferred to maintain a status quo amid market uncertainties, the report showed.

By Bae Hyun-jung (tellme@heraldcorp.com)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)