PM vows stern measures against illegal private finance

By Choi Jae-heePublished : July 9, 2020 - 15:40

The South Korean government vowed to speed up measures to stem the rampant practices of illegal private lending Thursday.

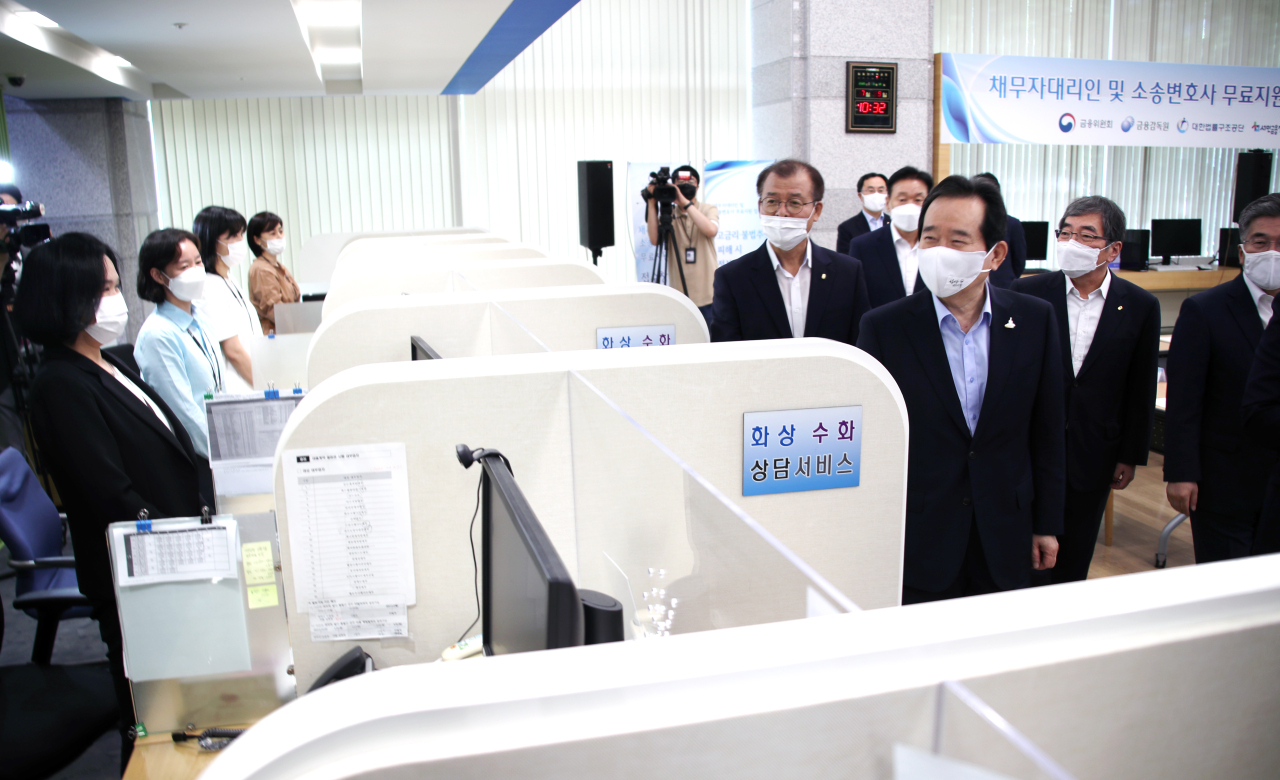

Prime Minister Chung Sye-kyun visited a counseling center within the market watchdog Financial Supervisory Service that addresses consumer damages caused by illicit private lending, which normally target low-income families with high interest rates and related frauds.

He was accompanied by FSS Gov. Yoon Suk-heun, Financial Services Commission Vice Chairman Sohn Byung-doo, and Min Gap-ryong, commissioner general of the Korean National Police Agency.

The move came in line with the latest set of government measures imposed in June under the FSC in order to protect financial consumers from illegal private finance. The policies involve slashing legal interest rate of 24 percent charged on private loans to 6 percent to suppress illegal private lenders’ incentives to fraud.

“Illegal private lending is unforgivable crime, pushing desperate people to a dead end. Recently, unregistered loan sharks have increasingly lured desperate families hit hard by the COVID-19 outbreak by pretending to be government agencies,” Chung said.

“(The government) will ramp up measures to protect financial consumers from illegal loan lenders who are trying to take advantage of deteriorating economic conditions.”

Meanwhile, the number of reports of financial damages from illegal private lending surged by 60 percent in April-May from a year earlier in the same period, according to data from the financial regulator.

By Choi Jae-hee (cjh@heraldcorp.com)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)