Korean firms to launch all-in-one ID verification app

By Yeo Jun-sukPublished : Oct. 21, 2019 - 17:00

South Korean mobile carriers, smartphone makers and financial firms have joined hands to simplify and decentralize the cumbersome online identity verification process.

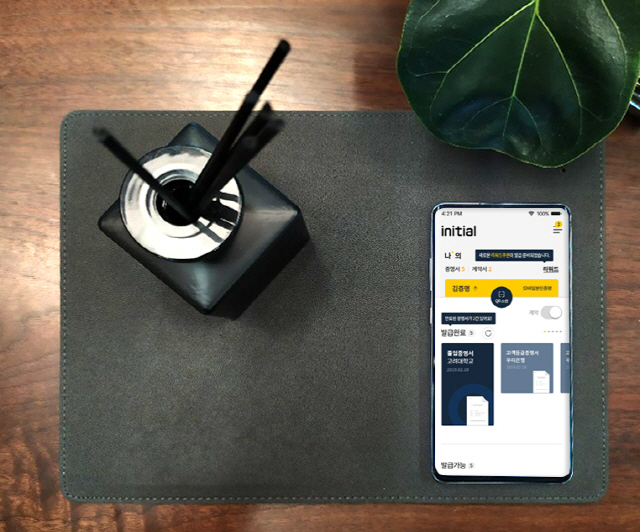

The decentralized ID service -- to be launched on a trial basis this year -- named Initial, will essentially verify an individual’s identity without tangible documents like graduation or employment certificates, and enable taking out loans or applying for jobs, through a single mobile app.

This is the second endeavor to launch a mobile identity verification system using blockchain technologies, after a similar effort by the Korea Financial Telecommunications & Clearings Institute.

On Sunday, a consortium of seven companies for a blockchain network named Initial DID Association announced they will be joined by three additional players for commercialization.

The original members include KT, SK Telecom, LG Uplus, Samsung Electronics, KEB Hana Bank, Woori Bank and fintech firm Koscom. The new members include BC Card, Hyundai Card, Shinhan Bank and NH NongHyup. The consortium was first created under an initiative of the Korea Internet and Security Agency in July.

Through the Initial app, an individual can connect to an organization of choice through a mobile e-verification app, and select a preferred certification. By using QR codes at each web service of the organization, one will be able to get or submit one’s certificate.

As the first step, the service will be connected with six domestic universities so users can download their graduation certificate or academic records through the mobile app to use them for various purposes such as when applying for jobs.

The app can also also be used to receive TOEIC record cards, or even as employee identification.

With the participation of credit card companies, the DID service is also expected to be used in simplifying credit card issuances and digitizing of customer information.

“The service can be used not just by consumers for financial transactions, but also by companies for recruitment, sales promotion and by their employees,” said an official from a local telecom firm.

The consortium said with more participation from different sectors in the future, the service could expand for taking out loans, and applying for insurance payments.

“It would be like carrying a one-membership card available at dozens of companies,” said an official from a local finance firm. “Companies can improve their services using the identification app.”

For security, Intitial uses blockchain technologies to secure the personal information data.

The consortium is also moving to develop global DID standards with GSM Association, an organization that represents the interests of mobile network operators worldwide.

(jasonyeo@heraldcorp.com)

![[KH Explains] How should Korea adjust its trade defenses against Chinese EVs?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/15/20240415050562_0.jpg&u=20240415144419)

![[Today’s K-pop] Stray Kids to return soon: report](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/16/20240416050713_0.jpg&u=)