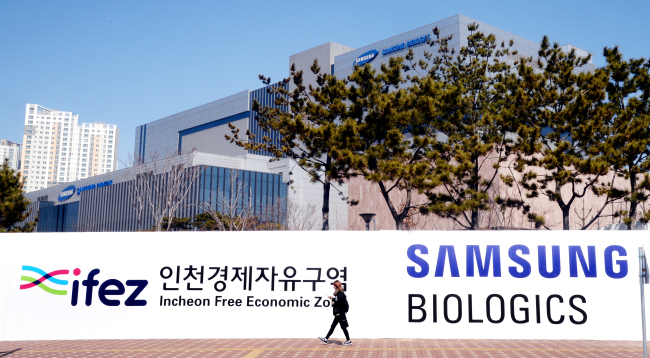

Samsung BioLogics, authorities to clash over accounting fraud case

By Sohn Ji-youngPublished : May 16, 2018 - 15:23

South Korea’s top financial regulator and Samsung BioLogics are set to butt heads Thursday over allegations that the Samsung-owned contract drug manufacturer committed accounting fraud by inflating its net profit ahead of its initial public offering in 2016.

The Financial Services Commission will be convening an initial meeting of its in-house accounting oversight panel on Thursday. It will then refer the case to the Securities and Futures Commission for a final decision.

The deliberations follow the Financial Supervisory Service’s tentative conclusion announced on May 1 that Samsung BioLogics had engaged in dubious accounting practices to ramp up its net profit in 2015 and receive a boost in its valuation.

The Financial Services Commission will be convening an initial meeting of its in-house accounting oversight panel on Thursday. It will then refer the case to the Securities and Futures Commission for a final decision.

The deliberations follow the Financial Supervisory Service’s tentative conclusion announced on May 1 that Samsung BioLogics had engaged in dubious accounting practices to ramp up its net profit in 2015 and receive a boost in its valuation.

Thursday’s meeting is scheduled to be held in a court-like format in which the FSS will present its arguments and evidence, which Samsung BioLogics will then refute with rebuttals.

Samsung BioLogics released a statement Wednesday saying that its CEO Kim Tae-han and core executives would “thoroughly explain its position on the ‘accounting violations’ raised by the FSS.”

“We have already submitted lots of evidence on the core issue in question, and plan to clearly explain our stance to the panel members as well,” it said.

The case hinges on the legality of how Samsung BioLogics came to acquire a net profit of 1.9 trillion won ($1.77 billion) in 2015 after posting four straight years of deficits.

At the time, Samsung BioLogics had changed its accounting method to reflect its holdings in its subsidiaries at fair market value, instead of at book value as was previously done, resulting in equity gains from its biosimilar-making unit Samsung Bioepis.

Under the new method, BioLogics came to categorize Bioepis as an affiliate, despite holding a 91.2 percent majority stake in Bioepis at the time. US-based Biogen had owned the remaining 8.8 percent stake.

Samsung BioLogics said that the change reflected the high likelihood that Biogen would exercise a call option to raise its stake in Bioepis to 50 percent minus one share, as the value of Bioepis had jumped on the regulatory approval of its copycat biologic drugs.

The call option, if exercised, would weaken Samsung BioLogics’ control over Bioepis, and Samsung BioLogics was advised by accounting experts to categorize Bioepis as an affiliate, in line with International Financial Reporting Standards, the firm said.

The main point of debate has been the legitimacy of Samsung Biologics categorizing Bioepis as an affiliate before Biogen’s execution of a call option.

So far, Biogen has yet to exercise the option, which expires in end-June. However, Biogen’s Chief Financial Officer Jeffrey Capello has confirmed the firm’s intentions during its first-quarter conference call.

The FSS is also looking into whether Samsung BioLogics changed its accounting standards to boost its valuation to help facilitate a controversial merger in 2015 between Samsung C&T and Cheil Industries that allowed Samsung’s heir apparent Lee Jae-yong to tighten his control over the conglomerate.

Samsung BioLogics is 75 percent owned by Samsung Electronics and Samsung C&T, the group’s de facto holding company. There are suspicions that Samsung buoyed the value of BioLogics to justify the merger ratio -- a claim which BioLogics has strongly denied.

By Sohn Ji-young (jys@heraldcorp.com)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/25/20240425050656_0.jpg&u=)