[News Focus] Moon reiterates financial reform drive with FSS chief nomination

By Bae Hyun-jungPublished : May 4, 2018 - 18:02

Even after the two previous leaders’ terms ended amid disputes, the next candidate tapped as chief of the financial market watchdog is, again, another reformative nonbureaucrat, reflecting the administration’s determination for financial reform.

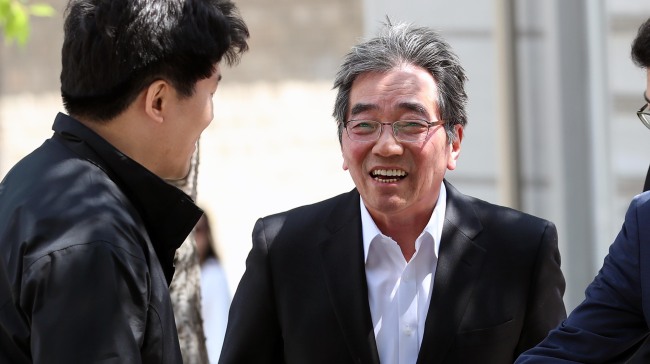

President Moon Jae-in on Friday approved Yoon Suk-heun as the new governor of the Financial Supervisory Service. Yoon is a visiting professor of business administration at Seoul National University and chairman of the FSC’s Financial Administration Innovation Committee.

The 70-year-old Yoon is to fill the top post that has been vacant for the past 18 days, upon the resignation of predecessor Kim Ki-sik. The FSS governor post does not require parliamentary approval.

“Yoon is the right person to lead financial reform drives in step with the fast-changing financial environment,” the FSC said in a statement.

The senior professor’s nomination came amid speculations that the Moon Jae-in administration may compromise by filling the FSS chief post with a conventional financial bureaucrat nominee.

President Moon Jae-in on Friday approved Yoon Suk-heun as the new governor of the Financial Supervisory Service. Yoon is a visiting professor of business administration at Seoul National University and chairman of the FSC’s Financial Administration Innovation Committee.

The 70-year-old Yoon is to fill the top post that has been vacant for the past 18 days, upon the resignation of predecessor Kim Ki-sik. The FSS governor post does not require parliamentary approval.

“Yoon is the right person to lead financial reform drives in step with the fast-changing financial environment,” the FSC said in a statement.

The senior professor’s nomination came amid speculations that the Moon Jae-in administration may compromise by filling the FSS chief post with a conventional financial bureaucrat nominee.

“Appointing an outsider (as leader) is a necessary gesture of change, when it comes to areas that require fundamental reforms,” the president said on April 13, as then-newly appointed FSS chief Kim came under fire for past overseas trips as a member of the parliament.

Since his early days in office, President Moon has vowed to eradicate the monopoly of the so-called “Mofia,” a compound term of “Ministry of Finance” and “Mafia,” which refers to the power group of former high-profile financial officials.

However, Kim resigned as the National Election Committee decided that his past disputed actions may be in violation of the law.

Kim’s predecessor Choe Heung-sik, another nonbureaucrat figure, had also stepped down abruptly in March this year amid mounting criticism over his alleged involvement in a bank recruiting corruption scandal.

The disgraceful exits of the two financial chiefs seemed to put a damper on Moon’s financial reform blueprint and added momentum to the conventional scenario of turning to a “financial insider” as a safe choice.

But the rise of the progressive economist is expected to push the stalled reform drive. Having served as economic adviser in Moon’s first presidential election camp in 2012, Yoon is considered a key projector for Moon’s financial policy blueprint. He has made “anti-conglomerate” remarks, including his advice to the FSC that the borrowed-name accounts of Samsung Group Chairman Lee Kun-hee should be subject to a penalty.

He is also an advocate of a stronger financial supervisory system that focuses on consumer protection and operational transparency -- a tone which largely aligns with President Moon’s economic pledges.

Nevertheless, concerns were raised over the scholar’s lack of field experience, as well as possibilities that he may conflict with the top regulator FSC in the process of reforms, with regard to his opposition to financial bureaucracy.

“Conglomerates and bureaucrats tried to avoid the wolf but they are now about to face the tiger,” Rep. Park Yong-jin, lawmaker of the ruling Democratic Party of Korea and member of the parliamentary National Policy Committee, said in the wake of the initial reports on Yoon’s nomination.

“(Yoon’s nomination) came as a reaffirmation of the Moon administration’s financial reform initiative.”

By Bae Hyun-jung (tellme@heraldcorp.com)

![[KH Explains] How should Korea adjust its trade defenses against Chinese EVs?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/15/20240415050562_0.jpg&u=20240415144419)

![[Today’s K-pop] Stray Kids to return soon: report](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/16/20240416050713_0.jpg&u=)